How to Apply for the AMEX American Express Gold Rewards Card Today

The AMEX American Express Gold Rewards Card offers exceptional benefits, including 2 points per dollar on travel and everyday purchases, comprehensive travel insurance, no foreign transaction fees, and flexible reward redemption options. It’s perfect for maximizing savings on everyday spending and international travel.

How to Apply for a National Bank Allure Mastercard Credit Card

The National Bank Allure Mastercard offers up to 2% cashback, exclusive travel perks such as priority boarding and hotel deals, no foreign transaction fees, and comprehensive protection features. It's ideal for travelers and online shoppers seeking savings and security on both local and international purchases.

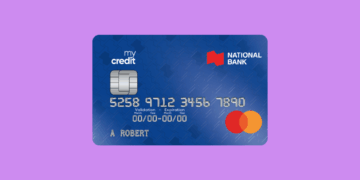

How to Apply for the National Bank mycredit Mastercard Credit Card

The National Bank mycredit Mastercard offers enticing benefits: earn cashback on everyday purchases, enjoy no annual fee, and receive purchase protection. With enhanced security features and flexible payment options, this card provides convenience and peace of mind for savvy consumers looking to maximize rewards and manage expenses efficiently.

How to Apply for Scotia Bank Plan Loan Easy Application Guide

The Scotia Bank Plan Loan offers flexible repayment options and competitive interest rates, allowing for personalized financial planning and potential savings. Enjoy convenient access to funds and no fees for early repayment, giving you the freedom to manage your debt efficiently and potentially expedite your payoff.

How to Apply for MBNA Smart Cash World Mastercard Credit Card

The MBNA Smart Cash World Mastercard offers valuable benefits, including cash back on groceries and gas, comprehensive travel insurance, purchase protection with extended warranties, and convenient contactless payments. These features provide significant savings, security, and ease for everyday purchases and travel plans.

How to Apply for MBNA True Line Mastercard Credit Card Easily

The MBNA True Line Mastercard offers low interest rates on purchases and affordable balance transfers, making it ideal for managing and reducing debt. Plus, with no annual fee, you can save even more, maximizing financial benefits without extra costs.

How to Apply for AMEX Marriott Bonvoy American Express Card Easily

The AMEX Marriott Bonvoy Card offers valuable travel rewards, earning up to 6 points per dollar at Marriott hotels and key categories. Enjoy a yearly Free Night Award, extensive travel insurance, and Priority Pass lounge access worldwide, making travel luxurious and secure.

How to Apply for the AMEX SimplyCash Credit Card from American Express

The AMEX SimplyCash Card offers valuable benefits, including cash back on everyday purchases, no annual fee, a special welcome bonus for new users, and access to exclusive American Express Invites. Enjoy these rewards while managing expenses effectively, enhancing your everyday spending experience.

Learn to Apply for MBNA Rewards Platinum Plus Mastercard Credit Card

Unlock generous rewards with the MBNA Rewards Platinum Plus Mastercard: earn points quickly on groceries, dining, and gas. Enjoy a valuable welcome bonus and flexible redemption options for travel or cash back. Plus, benefit from no annual fee, maximizing your savings and enhancing your spending power.

How to Apply for Scotia Momentum Visa Infinite Credit Card Today

The Scotia Momentum Visa Infinite Credit Card offers up to 4% cash back on groceries and bills, comprehensive travel insurance, 24/7 concierge service, and exclusive Visa Infinite offers. Protect your mobile devices with up to $1,000 insurance when purchased with the card for added peace of mind.